Open Banking offers various opportunities for the financial technology sector globally, with each region having its unique characteristics. This article focuses on three countries from different parts of the world: Australia, the U.K., and Japan. Despite distinct developmental histories in each country, all three are embracing new regulations to bridge the gap between fintech and traditional banks. Let’s explore the different aspects of open banking in Australia, the U.K., and Japan.

Fintech Regulations around the Globe: Current Status

Slightly Slow but Purposeful Introduction in Australia

Initially intended to oversee personal data management, Open Banking regulations have evolved in Australia. Beyond banking data, consumers can now share information regarding their loans and mortgages.

The Australian Competition and Consumer Commission oversees the operations of four major banks – Nab, CommBank, ANZ, and Westpac. It also grants accreditations to financial companies, including fintech firms, that opt to adopt these new regulations.

The extensive launch of Open Banking is expected to reduce the dominance of the Big Four banks in Australia, which currently hold a market share of about 95%.

According to the latest report by ACCC, only two financial institutions have received accreditation, while 39 others are in the process. Though the public rollout of Open Banking was delayed due to privacy and security concerns, the pandemic has expedited the transition. Since the outbreak, significant progress has been made by major Australian banks and the government.

The Australian Treasury believes that Open Banking can aid individuals and small to medium enterprises (SMEs) in recovering from the severe economic impact of the pandemic. Enhanced data sharing can streamline financial management and reduce banking costs to facilitate a quicker recovery.

Impressive Advancements in the U.K.

The inception of Open Banking in the U.K. dates back to 2016. That year, the Competition and Markets Authority (CMA) released a report on retail banking, emphasizing the need for innovation in the financial sector.

Complex fee structures and account opening procedures for Small to Mid-sized Enterprises (SMEs) were identified as key areas requiring attention.

In response, the CMA proposed several measures, including an open API banking standard for sharing consumer data.

The Open Banking Implementation Entity, a collective of banks, fintech firms, SMEs, and others, was formed to ensure the secure sharing of financial records. However, the implementation of Open Banking commenced in January 2018 when banks gained the capability to share consumer data.

Since then, third parties with access to consumer data have been encouraging consumer payments through various means, such as providing unified services for accessing accounts across multiple banks and offering automated budgeting features and more.

Major Developments in Japan Elucidate Significant Discoveries

Japan was among the early adopters of Open Banking in Asia. In 2015, Japan’s Financial Services Agency (FSA) established a consultation desk to enhance payment accessibility, laying the groundwork for Open Banking.

Subsequently, the Bank of Japan made amendments to the Banking Act twice within a couple of years. In 2017, regulations were revised regarding ownership stakes that banks must hold in fintech entities. This was followed by the introduction of a framework for overseeing e-payments. In 2018, the FSA set up the Strategic Development & Management Bureau to formulate a new financial services strategy with fintech as a primary focus.

Given Japan’s reliance on cash transactions, there has been a shift towards cashless and digital payments. The demand for such payment methods surged due to the 2020 Tokyo Olympics, despite its postponement by Japanese authorities.

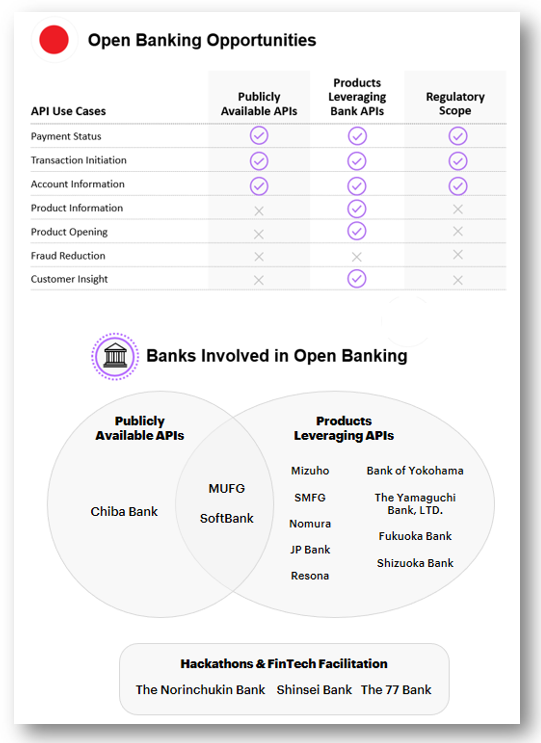

Various measures have been undertaken to embrace Open Banking, including collaborations between national and regional entities and partnerships among banks without the need to build API portals.

A significant milestone was achieved in October 2017 when three major banks – Mizuho, Sumitomo Mitsui, and MUFG – agreed to establish a universal QR payment system. In May 2018, Resona Banks, Fukuoka, and Yokohama collaborated to develop a QR code payment system named “Yoka Pay.”

Although there have been numerous initiatives, many Japanese banks have opted to collaborate after complying with the new regulatory framework.

Future Prospects of Open Banking Worldwide

While Open Banking has made significant strides in the U.K. and Japan, Australia is still in the early stages of implementation. In all the countries discussed, governmental support played a vital role in initiating Open Banking. Moving forward, local banks and regulatory bodies will continue to drive related initiatives to ensure the sustainable development of Open Banking globally.